When you finally move into that perfect home near Minnehaha Creek or along the Mississippi River, flood insurance might be the last thing on your mind. But then a letter from the lender shows up: “Because your property is in a flood zone, flood insurance is required.” Worse yet, the quote is way higher than expected. That’s when many Minneapolis homeowners start hearing about flood elevation surveys. These surveys are often the missing piece that can lower your flood insurance rates and even help you challenge the flood zone designation entirely.

What Are Flood Elevation Surveys?

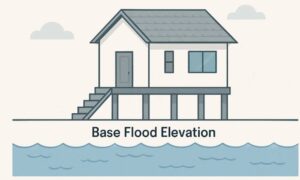

A flood elevation survey is a professional measurement that shows how high your home or building is compared to the level where a serious flood is expected to reach. That flood level is called the Base Flood Elevation, or BFE.

If your home is above that level, you’re considered lower risk. If it’s below, the insurance company sees it as more likely to flood and they charge more.

A licensed land surveyor performs the survey and provides an Elevation Certificate, which includes all the measurements insurers and FEMA need to understand your flood risk.

Why These Surveys Matter in Minneapolis

Minneapolis is filled with water, lakes, creeks, rivers, wetlands you name it. And while all that water adds beauty to the city, it also means some properties are at risk during storms, heavy snow melts, or spring floods.

FEMA creates flood maps to estimate this risk. But those maps are broad and don’t know the exact elevation of your specific house. That’s where flood elevation surveys come in. They give you the precise data for your home, not just your neighborhood.

How Flood Elevation Surveys Affect Insurance Rates

Without a survey, insurance companies make assumptions. And unfortunately, those assumptions usually aren’t in your favor.

They assume your home is at the flood level or below it. That puts you in a high-risk category and leads to higher premiums.

But if a flood elevation survey shows your property sits a few feet above the Base Flood Elevation, you may be eligible for a much lower rate. In some cases, people in Minneapolis have saved hundreds or even thousands of dollars each year on insurance, just by submitting an updated Elevation Certificate.

It’s a one-time survey that can lead to long-term savings.

When You Should Get a Flood Elevation Survey

Not every homeowner needs one, but in certain situations, it’s absolutely worth it. Here’s when you should seriously consider getting a survey done:

- You’re buying a home in a mapped flood zone

- Your flood insurance premium seems unusually high

- You believe your home is higher than the flood maps suggest

- You want to request a Letter of Map Amendment (LOMA) to challenge FEMA’s designation

- You’re building or remodeling in a flood-prone area

- Your lender or insurer requests an Elevation Certificate

If your property is near bodies of water like Minnehaha Creek, Shingle Creek, or close to low-lying areas in South Minneapolis, this is especially important.

How the Process Works in Minneapolis

Getting a flood elevation survey is pretty straightforward:

- Contact a licensed land surveyor — Make sure they understand FEMA guidelines and local Minneapolis flood zones. Many surveyors also offer Elevation Certificate services, which means they handle all the paperwork and measurements you need to submit to your insurer.

- Schedule the survey — The surveyor visits your property and takes precise elevation measurements of your home’s lowest floor and key points.

- Receive your Elevation Certificate — This official document shows exactly how your property compares to the Base Flood Elevation. It’s the key piece your insurance company needs to reassess your flood risk.

- Submit the certificate to your insurance company — With this updated data, your insurer can recalculate your premium, often lowering your flood insurance costs.

In Minneapolis, a flood elevation survey usually costs between $500 and $900, depending on your property size and complexity. But for many homeowners, the long-term savings on insurance premiums make it a smart investment.

A Real Example: From Overpaying to Big Savings

Let’s say a homeowner near the Mississippi River is paying $2,000 a year in flood insurance. FEMA’s flood map puts the home in Zone AE, which signals high risk.

A flood elevation survey is done, and the results show the home’s lowest floor is two feet above the Base Flood Elevation. With this new data, the insurance company adjusts the rate and the premium drops to $950 per year.

That’s a savings of over $1,000 just from getting the right information in front of the insurer.

More Than Just Lower Premiums

While most people get a flood elevation survey to reduce their insurance costs, the benefits go beyond that:

- You gain peace of mind, knowing your actual risk.

- If you’re selling your home, an Elevation Certificate is a valuable bonus for buyers.

- If you plan to build or renovate, the city may require this data for permits.

- It helps with flood mitigation planning and long-term property protection.

Basically, it’s about being informed and making smarter choices based on facts, not guesses.

Final Thoughts:

Living near water in Minneapolis definitely has its perks: beautiful views, peaceful surroundings, and easy access to nature. But let’s be honest: it also comes with some real risks, especially when it comes to flooding.

That’s why getting a flood elevation survey is one of the smartest things a homeowner can do. It helps you understand your property’s actual flood risk and gives you the documentation you need to get a fair, accurate insurance rate.

For anyone living near rivers, creeks, or other flood-prone areas, flood elevation surveys can make a real difference not just in insurance premiums, but in peace of mind. You’ll know exactly where your home stands, literally, and whether you’re being charged fairly.

It’s a small, one-time investment that can lead to long-term savings, better protection, and fewer surprises. If you suspect your home sits higher than FEMA maps show, or you’re just done overpaying for flood insurance, this is the step that puts you back in control.

At the end of the day, flood elevation surveys aren’t just paperwork, they’re about protecting your home, your finances, and your future.