This week’s deep freeze did more than burst pipes and overload sump pumps. Across Minneapolis, many homeowners fixed their water damage, cleaned their basements, and tried to move on. However, some later received an unexpected message. Their lender or insurance company suddenly asked for an elevation certificate.

For many people, that request came out of nowhere. Their homes never flooded. They never needed flood insurance before. So why now?

The answer connects to how large winter water events trigger wide risk reviews. While the cold weather has passed, the paperwork has just begun.

When Winter Damage Triggers Risk Reviews

During extreme cold, thousands of homes suffer water damage at the same time. Pipes freeze and burst. Ice dams force water inside walls. Blocked drains push melting snow back into basements. Because of this, insurance claims increase across entire neighborhoods.

As a result, insurance companies and mortgage lenders often start large review processes. They do not only look at single homes. Instead, they review entire areas. They check flood zone records. They confirm risk data. They update compliance files.

These reviews usually happen weeks after the storm, not during cleanup. That delay explains why homeowners receive new document requests long after repairs finish.

In many cases, those reviews lead to requests for an elevation certificate.

Why Elevation Certificates Suddenly Appear

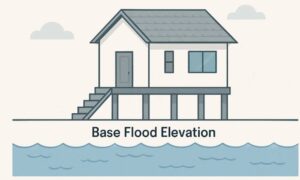

Flood maps show risk by area, not by the height of each home. However, lenders and insurers need exact data when questions about risk appear. They must confirm how high a home actually sits.

That is where an elevation certificate becomes useful.

An elevation certificate shows precise measurements of a home’s height compared to mapped flood levels. It gives lenders and insurers clear numbers instead of guesses.

So after major winter water events, many companies rely on elevation certificates to confirm real risk. They do not assume danger. Instead, they verify it.

Although the request may feel sudden, it follows normal review steps.

Why Minneapolis Homes Feel This Impact More

Minneapolis faces special challenges that make winter water problems more severe.

First, frozen soil blocks natural drainage. When snow melts quickly, water has nowhere to go. As a result, it collects near foundations and leaks into basements.

Second, ice dams stop roof drainage. Warm air escapes into attic spaces, which melts snow unevenly. Water backs up under shingles and enters walls.

Third, many neighborhoods include older homes. These houses often have lower foundations, aging drainage systems, and limited waterproofing.

Finally, homes near rivers, creeks, and low areas receive extra attention. Even when these homes never flood, lenders still review their risk more closely.

Because of these factors, winter storms often trigger more document checks in Minneapolis than in many other cities.

Common Situations That Trigger Elevation Certificate Requests

Many homeowners believe document requests only happen after floods. In reality, several everyday situations can lead to elevation certificate requirements.

Water damage claims often trigger reviews, even when frozen pipes or ice dams cause the damage. Refinancing also brings new loan checks, which can uncover missing or outdated records. Home sales involve buyer and title company reviews, which often require updated documents. Switching insurance providers may lead to new compliance checks. Mortgage servicing changes can also reveal missing paperwork.

In each case, the request feels sudden. However, it simply reflects updated risk reviews.

Why This Request Confuses So Many Homeowners

Most people connect flood risk with major disasters. If their home never flooded, they believe no risk exists. Because of this, elevation certificate requests feel unnecessary.

However, lenders and insurers do not rely only on experience. They use official documents and compliance rules.

In addition, flood maps change over time. Drainage systems improve. Land grading shifts. New buildings alter water flow. Because of this, older records may no longer match current conditions.

As a result, document updates happen more often after major weather events.

Although the process feels stressful, it helps maintain accurate risk data for entire neighborhoods.

What Many Homeowners Think an Elevation Certificate Is

The term “elevation certificate” sounds complex, which causes confusion.

Some homeowners believe it works like a home inspection. Others think it relates only to flood insurance. Some even confuse it with property appraisals.

In reality, an elevation certificate simply shows how high key parts of a home sit compared to mapped flood levels. It does not check building quality. It does not set insurance prices. It does not determine market value.

Instead, it provides verified elevation data used during compliance reviews.

When Acting Quickly Prevents Major Delays

Timing plays a big role.

When homeowners act early, they often avoid delays during refinancing, home sales, insurance changes, and mortgage updates.

In these situations, lenders set strict timelines. Missing documents can delay approvals and closings. However, ordering an elevation certificate early helps keep everything moving smoothly.

On the other hand, when no sale or loan change exists, urgency decreases. Homeowners can usually schedule documentation at a slower pace.

Why Local Survey Experience Matters

Not all properties face the same flood risk. Minneapolis includes complex elevation patterns shaped by rivers, creeks, past grading, and urban growth.

Local survey professionals understand these patterns. They know neighborhood drainage behavior, historic construction styles, and city zoning rules. This experience improves accuracy and reduces the chance of errors.

As a result, working with local experts often saves time, stress, and extra cost.

Why Elevation Certificates Bring Clarity, Not Panic

Many homeowners feel anxious when lenders request new documents. However, elevation certificates often bring peace of mind.

Instead of guessing about flood risk, homeowners receive clear answers. They understand their home’s true position compared to mapped flood levels.

In many cases, this clarity removes worry. Homeowners stop wondering about hidden danger and start relying on facts.

This confidence becomes valuable during future refinancing, home sales, and insurance updates.

Final Thoughts

Minneapolis’ recent deep freeze did more than freeze pipes. It triggered wide risk reviews across the housing system. As a result, many homeowners now receive unexpected requests for elevation certificates.

While the process may feel frustrating, it serves a useful purpose. It confirms real risk. It updates old records. And it prevents future compliance problems.

If your home suffered winter water damage or your lender suddenly requested documentation, an elevation certificate may simply be the next step toward clarity.

With accurate elevation data, homeowners replace uncertainty with confidence and move forward with peace of mind.